Promoting Financial Literacy Through Real-World Budgeting Exercises

It is crucial to have a solid grasp on personal finances in order to navigate the complexities of financial matters effectively. Understanding personal finances involves being aware of one’s income, expenses, debts, and investments. Without this knowledge, individuals may find themselves in precarious financial situations that could have been avoided with proper planning and insight.

Moreover, having a clear understanding of personal finances empowers individuals to make informed decisions about their money. From setting realistic financial goals to establishing a budget and managing debt, being financially literate is key to achieving financial stability and security. By taking the time to educate oneself on personal finances, individuals can pave the way for a more secure financial future.

Benefits of Teaching Budgeting Skills

Understanding how to budget effectively is a crucial skill that can bring about countless benefits in one’s life. By honing budgeting skills, individuals gain a better grasp of their financial situation and how to manage it proactively. This leads to greater control over spending habits, increased savings, and overall financial stability.

Moreover, teaching budgeting skills fosters a sense of responsibility and accountability in individuals when it comes to managing their money. It promotes a mindset of being intentional with financial decisions, prioritizing needs over wants, and setting achievable financial goals for the future. Ultimately, the ability to budget not only impacts personal finances positively but also instills valuable life skills related to planning, discipline, and foresight.

Engaging Budgeting Activities for All Ages

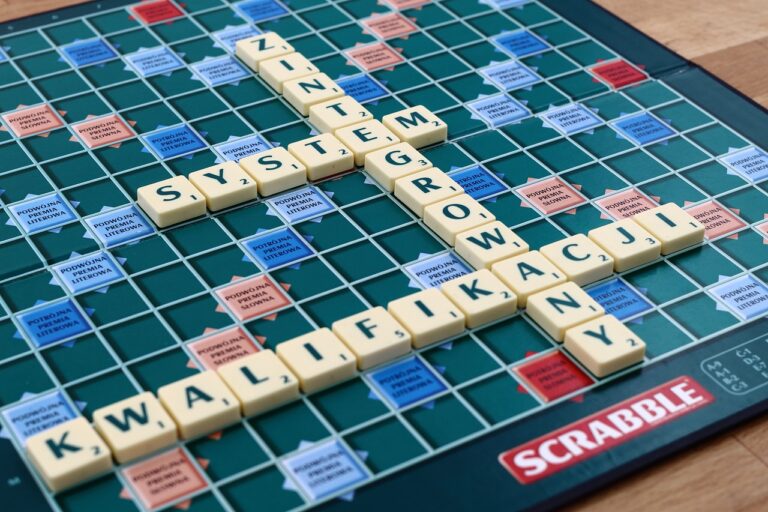

Whether you are a child learning about money management for the first time or an adult looking to improve your financial literacy, engaging in budgeting activities can be both fun and educational. One popular activity is creating a budgeting board game that incorporates real-life financial scenarios. This interactive game can help players understand the importance of budgeting, saving, and making smart financial decisions.

Another engaging budgeting activity for all ages is setting up a mock store or market at home. Participants can take turns being the shop owner and the customer, practicing budgeting skills by deciding how much to spend and what items to purchase within their budget constraints. This activity not only teaches financial responsibility but also promotes critical thinking and decision-making skills in a playful setting.